Essential Excel Skills Every Accountant Should Master

In the world of accounting, Microsoft Excel stands as an indispensable tool for managing, analyzing, and presenting financial data. Mastering Excel not only enhances productivity but also ensures accuracy and efficiency in accounting tasks. Whether you’re a seasoned accountant or just starting your career, developing a robust set of Excel skills is crucial. In this blog post, we’ll explore the essential Excel skills that every accountant should have to excel in their role.

1. Advanced Formulas and Functions

To handle complex financial calculations, accountants must be proficient with advanced Excel formulas and functions. Key formulas include:

VLOOKUPandHLOOKUP: These functions help retrieve data from tables and ranges, essential for cross-referencing and data analysis.IFandIFS: Used for conditional logic to perform tasks based on specific criteria.SUMIFandCOUNTIF: Allow for conditional summing and counting based on criteria, ideal for financial summaries and reporting.

Mastering these formulas ensures accurate calculations and efficient data management.

2. PivotTables and PivotCharts

PivotTables are powerful tools for summarizing and analyzing large datasets. Accountants should know how to:

- Create and Customize PivotTables: Summarize financial data, identify trends, and perform in-depth analysis.

- Design PivotCharts: Visualize data with charts linked to PivotTables for clear and impactful presentations.

These skills are vital for creating comprehensive financial reports and extracting actionable insights from complex datasets.

3. Data Validation and Error Checking

Ensuring data integrity is crucial in accounting. Excel’s data validation and error-checking features help maintain accuracy:

- Data Validation: Restrict data entry to specific types or ranges to prevent errors and ensure consistency.

- Error Checking: Use built-in tools to identify and correct errors in formulas and data entries.

These skills help maintain reliable financial records and reduce the risk of mistakes.

4. Financial Modeling and Forecasting

Accountants often build financial models to project future financial performance and evaluate scenarios. Proficiency in:

- Creating Financial Models: Design models using Excel to forecast revenues, expenses, and financial outcomes.

- Using Financial Functions: Apply functions like

NPV(Net Present Value) andIRR(Internal Rate of Return) for investment analysis and decision-making.

Effective financial modeling helps in strategic planning and informed decision-making.

5. Macros and VBA (Visual Basic for Applications)

For automating repetitive tasks and enhancing efficiency, accountants should be familiar with:

- Recording and Writing Macros: Automate common tasks to save time and reduce manual effort.

- Basic VBA Programming: Customize and extend Excel’s functionality with VBA code to handle complex processes.

Mastering Macros and VBA allows for streamlined workflows and improved productivity.

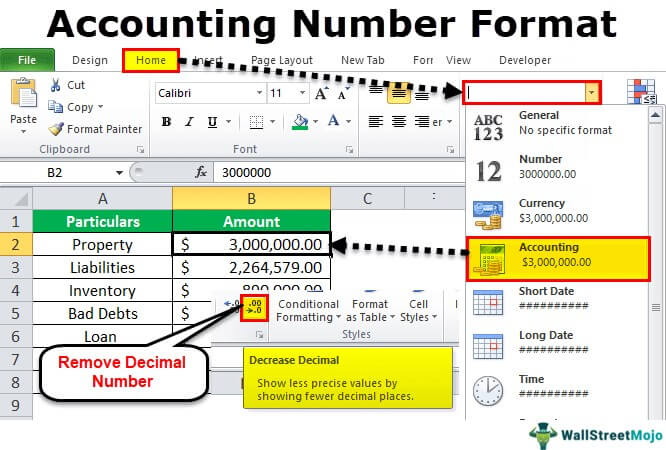

6. Data Analysis Tools

Excel provides a range of data analysis tools that accountants should be adept at using:

- Conditional Formatting: Highlight key data points and trends with color coding and formatting rules.

- What-If Analysis: Utilize tools like Scenario Manager, Goal Seek, and Data Tables to explore different financial scenarios.

These tools help in analyzing financial data and making data-driven decisions.

7. Data Visualization

Visualizing data effectively is essential for clear communication. Accountants should know how to:

- Create and Customize Charts: Use various chart types such as line, bar, and pie charts to represent financial data visually.

- Design Dashboards: Build interactive dashboards that consolidate and present key financial metrics and trends.

Effective data visualization aids in presenting financial information in an understandable and impactful manner.

8. Workbook and Worksheet Management

Efficient workbook and worksheet management ensures organization and ease of use:

- Organize and Structure Workbooks: Use multiple sheets and organize data logically for better clarity and navigation.

- Protect and Share Workbooks: Apply password protection and manage sharing settings to secure sensitive financial data.

These skills help maintain well-organized and secure financial documentation.

9. Importing and Exporting Data

Accountants frequently work with data from various sources. Skills in:

- Importing Data: Bring data into Excel from external sources like databases and online services.

- Exporting Data: Export Excel data to other formats (e.g., CSV, PDF) for reporting and sharing.

These skills ensure seamless integration and dissemination of financial data.

10. Keyboard Shortcuts and Efficiency Tips

Boosting efficiency in Excel can be achieved through:

- Keyboard Shortcuts: Learn shortcuts for common tasks to speed up data entry and navigation.

- Efficiency Tips: Utilize features like AutoFill, Flash Fill, and Named Ranges to streamline your workflow.

Improving efficiency helps in handling large volumes of data and performing tasks more quickly.