Maximizing Efficiency: How Accountants Use Excel to Streamline Financial Tasks

In the realm of finance and accounting, Microsoft Excel is a cornerstone tool that significantly enhances productivity and accuracy. From budgeting to financial reporting, Excel provides accountants with a versatile platform to manage, analyze, and visualize data. In this blog post, we’ll explore the various ways accountants utilize Excel to streamline their financial tasks and boost efficiency.

1. Budgeting and Forecasting

Excel is widely used by accountants for budgeting and forecasting purposes. By creating detailed budget templates, accountants can track income and expenses, compare actual performance against budgeted figures, and make informed financial projections. Excel’s built-in functions, such as SUM, AVERAGE, and FORECAST, enable precise calculations and trend analysis.

2. Financial Reporting

Generating financial reports is a critical task for accountants, and Excel excels in this area. With its powerful features, accountants can create balance sheets, income statements, and cash flow statements with ease. Excel’s customizable templates and formatting options allow for clear and professional presentation of financial data.

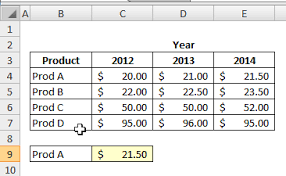

3. Data Analysis and PivotTables

Data analysis is a core function of accounting, and Excel’s PivotTables are a game-changer. PivotTables enable accountants to summarize large datasets, perform complex calculations, and extract meaningful insights from financial data. This tool simplifies the process of analyzing trends, identifying anomalies, and generating detailed reports.

4. Reconciliation and Verification

Accountants often use Excel to reconcile accounts and verify financial data. By creating reconciliation templates and using functions like VLOOKUP and IF, they can efficiently match transactions, identify discrepancies, and ensure that financial records are accurate and complete.

5. Expense Tracking and Management

Tracking expenses is vital for maintaining financial control, and Excel provides a user-friendly platform for this task. Accountants can design expense tracking spreadsheets to record and categorize expenditures, monitor spending patterns, and generate expense reports for review and approval.

6. Financial Modeling

Excel is a powerful tool for financial modeling, allowing accountants to build detailed financial models that simulate various scenarios and outcomes. Accountants use formulas and functions to create projections, evaluate investment opportunities, and assess the impact of financial decisions.

7. Automation and Macros

To increase efficiency, accountants leverage Excel’s automation features, such as Macros and VBA (Visual Basic for Applications). By recording and writing Macros, accountants can automate repetitive tasks, streamline data entry processes, and reduce the risk of manual errors.

8. Data Visualization

Excel’s charting and graphing capabilities are essential for data visualization. Accountants use these features to create charts, graphs, and dashboards that present financial data in a visually appealing and easily understandable format. This helps stakeholders quickly grasp financial performance and trends.

9. Tax Preparation

Tax preparation is a critical area where Excel proves invaluable. Accountants use Excel to organize and calculate tax-related data, prepare tax returns, and ensure compliance with tax regulations. Custom spreadsheets and templates help streamline the process and reduce the likelihood of errors.

10. Financial Analysis

Excel’s analytical tools assist accountants in performing detailed financial analysis. Functions such as NPV, IRR, and PMT are used to evaluate investment opportunities, assess loan payments, and analyze profitability. Excel’s flexibility allows for in-depth financial analysis tailored to specific business needs.